In the world’s busiest robotics market, change is arriving quietly. While China’s biggest factories continue to invest in automation, ABB is now focusing on a different customer: the mid-sized manufacturer.

These companies are growing, but many don’t have the budget or technical teams that larger firms rely on. ABB’s new Lite+, PoWa, and IRB 1200 robots aim to fix that. Designed for smaller spaces and easier use, these machines are opening new doors for companies that need automation but can’t afford the complexity.

Simpler Robots, Faster Setup

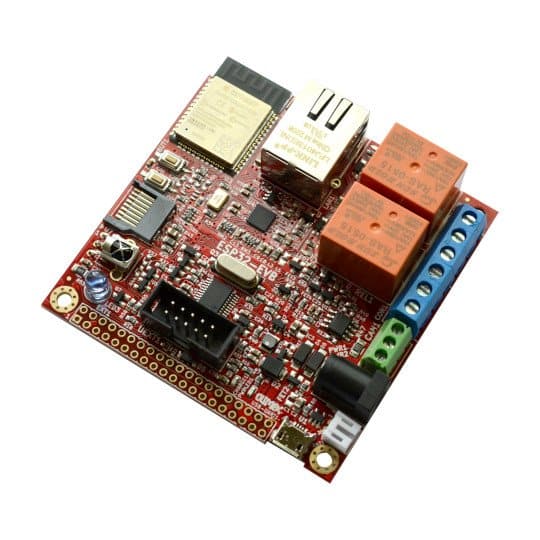

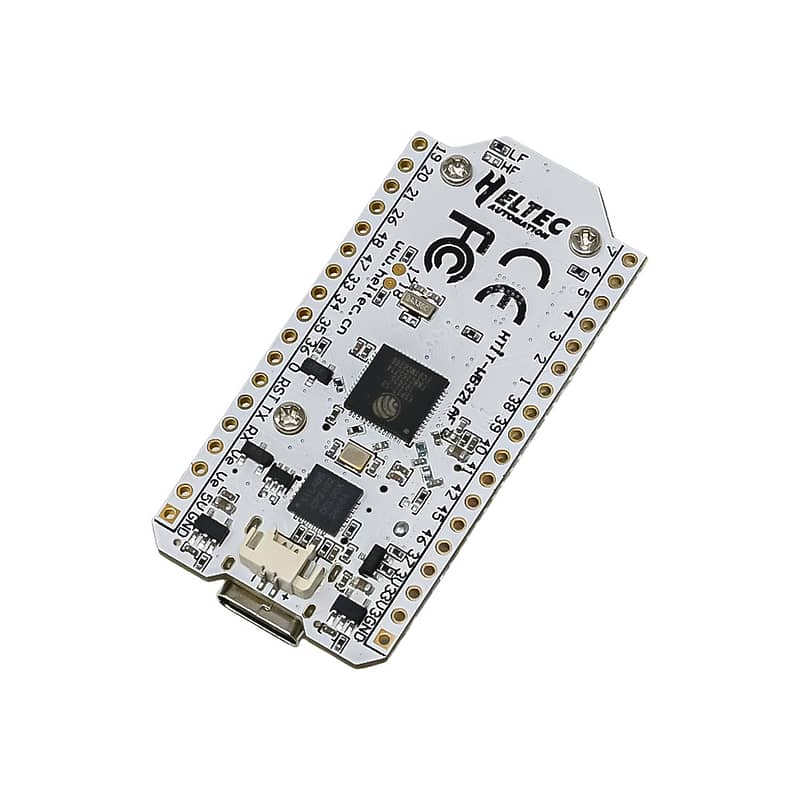

Lite+ is built for basic factory jobs. It handles pick-and-place tasks and simple material movement. The updated IRB 1200 offers more precision. It is compact enough for tight production lines and quick enough for repetitive assembly work.

PoWa is ABB’s new collaborative robot. It is faster than many other cobots on the market. Most importantly, it can be up and running within an hour. Programming is done through spoken commands or simple task demonstrations. That means even small teams can learn to operate it without outside help.

Each robot runs on ABB’s OmniCore controller. This system supports cloud connections, edge computing, and built-in AI tools. These features give operators real-time updates and make it easier to adjust workflows as needed.

Built in China, for China

More than 90 percent of ABB robots sold in China are now made in Shanghai. That includes the full lineup of new mid-market models.

This approach cuts delivery times and improves local support. It also allows ABB to respond faster to what Chinese manufacturers actually need. By building locally, the company can tailor products and services more directly.

This localisation also supports China’s broader goals. The country is investing heavily in smart manufacturing. ABB’s decision to produce and support robots within China helps it stay aligned with this national push.

Understanding the ROI

Smaller companies have often avoided robots because the upfront costs seemed too high. ABB is changing that by offering lower-priced models with faster payback.

The Lite+ starts at around $20,000. For many factories, these systems can deliver a return on investment within 12 months. That’s possible through reduced errors, higher throughput, and fewer staffing issues.

The PoWa robot is designed to cut setup and training time to almost zero. Once it is operational, it can take on repetitive tasks without breaks or downtime. This saves both time and labour costs.

Companies that automate even one or two steps of production can see meaningful gains. Instead of spending more on labour or expanding floor space, they can increase output using existing resources.

Why Mid-Sized Firms Matter Now

China’s mid-sized factories make up a large part of the country’s industrial base. Many still rely on manual labour. Rising wages and staff shortages are forcing change.

Until now, robots were mostly used by large firms with deep pockets. ABB’s new approach is helping level the playing field. Smaller factories can now automate without major disruptions or long learning curves.

And because the robots are modular and scalable, it’s easy to start small and expand later. That flexibility gives companies a safer, lower-risk way to move forward.

How Mendy’s Robotics and AI Can Help

At Mendy’s Robotics and AI, we help manufacturers take the first step into automation. Whether you need to test a single robot or plan a larger rollout, we can help assess your needs and calculate ROI.

Our team works with businesses to choose the right system, understand the data, and plan for growth. With the right setup, automation can become a strength instead of a burden.

Ready to explore what ABB’s newest robots could do for your factory? Let’s talk about how you can start small, move fast, and stay ahead.

References

- https://stockinvest.us/digest/abb-unveils-game-changing-robots-for-chinas-mid-sized-market-targeting-20k-automation-solutions

- https://www.businesscirclemag.com/news/abb-launches-robots-for-mid-sized-chinese-manufacturers/

- https://www.techinasia.com/news/swiss-tech-giant-abb-launches-robots-for-chinas-mid-sized-firms

- https://autonews.gasgoo.com/icv/70038012.html